Introduction to Exit Planning

Most often, a business owner’s wealth depends on the value of their business (often 80-90% of their net worth), therefore it is important for business owners to plan their exit to achieve their desired retirement goals.

Yet, the usual excuses are:

“I am really busy addressing business issues. I cannot focus on it right now”.

“I will think about it when I’m ready to sell.”

“I am already getting feelers from potential buyers”.

Exit Planning Institute’s survey gives some serious data to ponder: · Only two out of 10 business that goes to market will close. · Of these 2 businesses that sells, only one does so at the owners’ terms.

With proper exit planning, business owners can take control of the outcome and avoid becoming another sad data point.

We specialize in helping business owners leave their companies on their terms and time lines.

Our team helps lower middle market business owners with exit planning offering that help them toward meeting personal, financial, family and business goals.

What is Exit Planning?

An exit plan outlines all the business, personal and financial issues involved in transitioning a company. It includes contingencies for the 5D’s: Death, Divorce, Disability, Disagreement, and Distress.

The plan’s purpose is to maximize the value of the business at the time of exit, minimize taxes and ensure the owner can accomplish all his or her personal and financial goals in the process.

There are three major components to the exit planning approach, referred to as the “Three Legs Of The Stool ”:

1. Maximizing Business Value

2. Personal Financial planning

3. Life After Business Planning

Reference:

Peter Christman | Cofounder of the Exit Planning Institute | Author of The Master Plan

Why Does It Matter?

100% of business owners will stop being business owners at some point whether they choose it or not. Exit planning matters because it enables you to take charge of how and when you exit.

For most business owners, 80-90% of their net worth is in the business, but that wealth is of little value if it is not transferable. Exit planning help the business transferable and ready for the transition.

Exit Planning lets owners stay in control of the most important aspects in their lives: their businesses, their legacies, their families, and their third act in life. It helps them get the most money from their businesses when they exit.

What’s The Process?

Our processes prepare the business for success while preparing for the transition. Through a series of interviews, surveys, number crunching, and meetings, a project plan is developed and managed. One of the most important steps is building and managing your transition team: tax advisors, wealth managers, attorneys, business insurance, personal insurance, family coaches, CPA’s, real estate agents, and others.

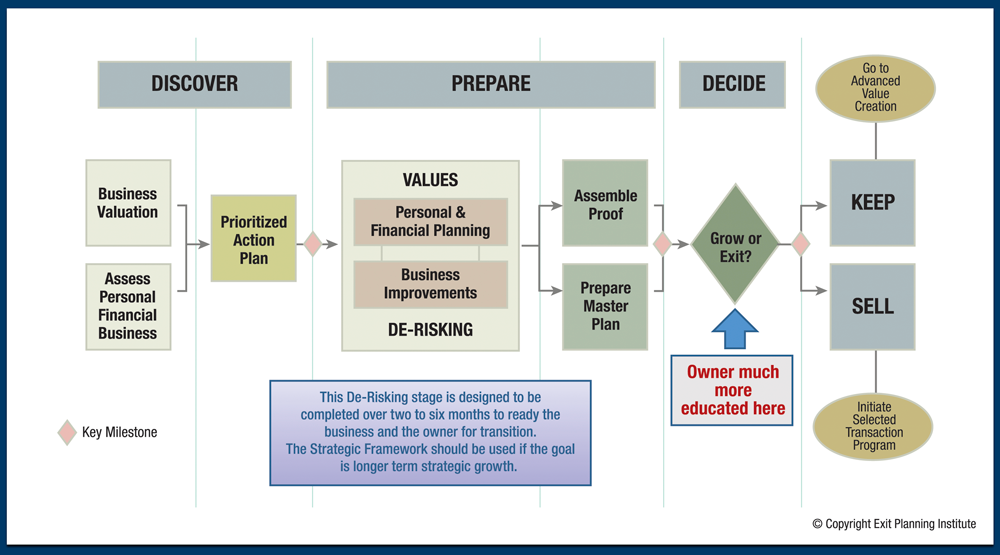

We coordinate with this transition team so that you can continue to focus on the day to day affairs of running your business. You will receive the information you need to make the decision regarding your exit plans, and the professional help you need during the three gates in The Value Acceleration Methodology: DISCOVER, PREPARE, and DECIDE

Are You Ready?

It is critical for each owner to have an initial assessment and understanding of her/his transition readiness. To assist with this understanding, we offer powerful, yet simple, assessment tools that is FREE to you.

It only takes about 20 minutes and you get custom reports highlighting your readiness in two key areas: personal readiness, business attractiveness to the buyer. In addition, we also give you a FREE tool to assess the current value of your business.

Interested in learning your business attractiveness score?

Our free assessment tool!